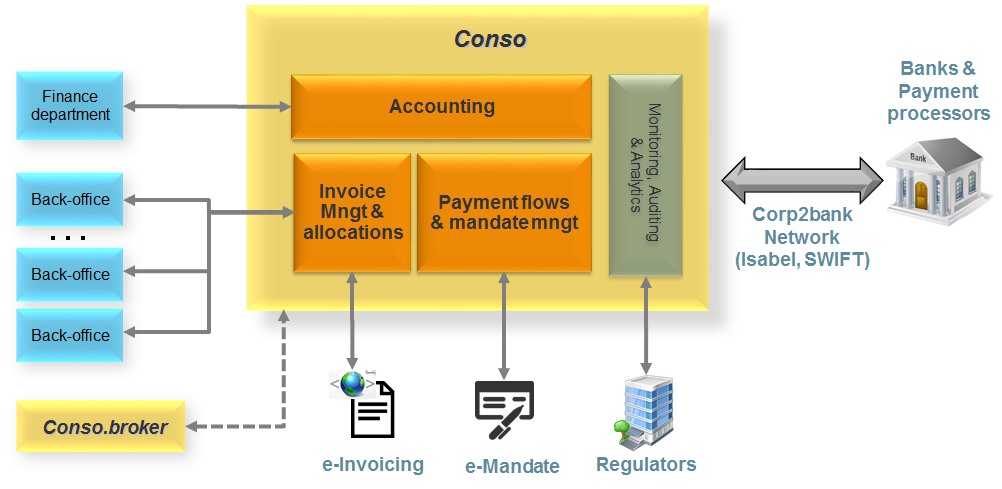

- Centralization of all payments

Including shared

service centers for multiple entities

- Harmonization of processes and systems

- Payment allocation based on business rules, currency

conversion

- Payment lifecycle automation: mandate management, reminder

processing

- Invoices/bills reconciliation

- Harmonization around SEPA and evolution towards PSD 2

- Real-time visibility over cash, on payment status and on

rejections

- Aggregated view on all company payments, in multiple

currencies

- Instant accounting for both general ledger & analytical

accounting

- Reduction of operational risk

- Comprehensive auditing, reporting and alerting

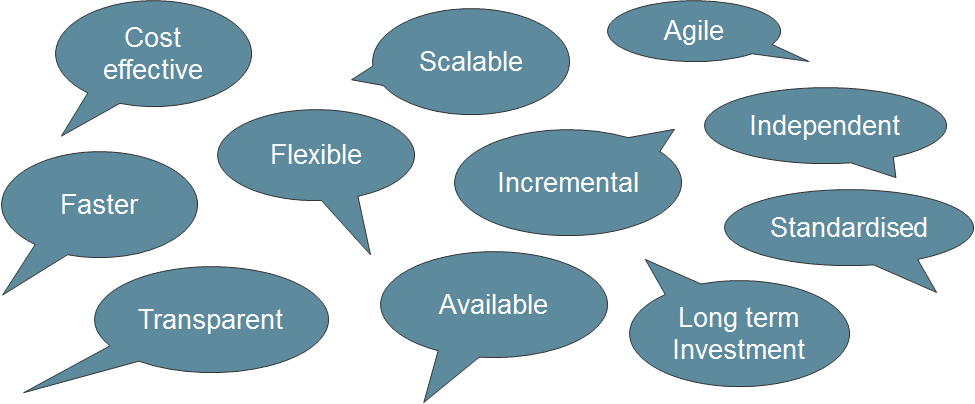

- Increased visibility over cash

- Aggregated view of all payments

- Facilitate better liquidity management

- Real-time business dashboard

- Better control on cash management processes

- Full management of subsidiary payments

- Centralized processing enhancing efficiency

- Automated matching of payments

- Rule-based invoice allocation for

payments

- Exception based processing

- Alerting system

- Scoring based on

customer behavior analysis

- Based on widely adopted Industry

standards

- Real-time reporting (detailed, consolidated, …)

- Embedded accounting & general ledger

- Full auditing

- Reduced operation risk (replaced fax usage, avoid multiple independent systems,…)

- Leveraging electronic Invoicing/billing

- Electronic direct debit mandates

management

- Electronic signature

- support of ISO 20022 formats

- Digitalization of broker communications

- Multi-channel communication

- Fraud prevention using analytics

One-D offers the services of highly

qualified and experienced professionals skilled in business

consulting, system design, implementation and support.

Having proven expertise & familiar with recent evolutions in

the banking and insurance industry our consultants speak the

language of bankers and insurers.

One-D also provides "conso" the leading-edge solution for

insurers.

+32 477 204.004 / +32 2 211.3479

Olivier.Dheulin@one-d.com

Rue des Palais, 44/29

1030 Brussels, Belgium